Table Of Content

It is important to note that interest rate is not the only factor to consider. If you are buying a property in another state or city, it is important to calculate the cost of living in the location before purchasing a property there. The down payment is the amount that the borrower is required to pay upfront in order to get a mortgage and purchase a house. It is a portion of the house’s price that you have to pay at closing. The minimum down payment most conventional lenders ask for is typically 20% of the house’s price. However, this can change depending on the lender, the type of mortgage you are applying for, and your creditworthiness as a borrower.

How To Calculate Mortgage Payments

None of this reassurance changes the fact that financial markets, which dictate swap rates, are pricing in delays. But, so far I'm still using a credit card, the most travelling I've done has been to work and back and there is still no rock on my finger. I have been given an annual pay rise, though, and would say I am less stressed. Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage (hail, wind and lightning) to your home.

Get a more accurate estimate

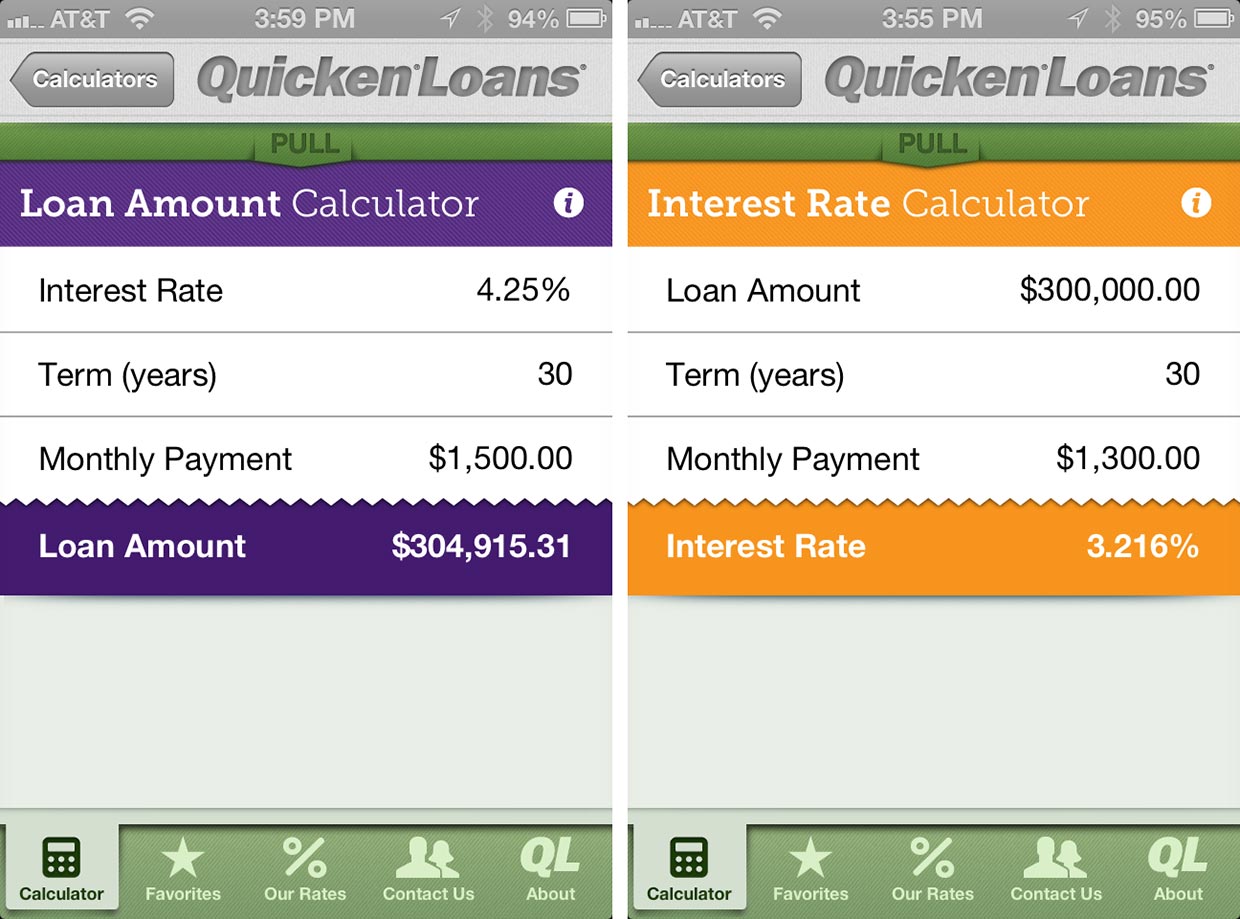

Whether you’re shopping around for a mortgage or want to build an amortization table for your current loan, a mortgage calculator can offer insights into your monthly payments. Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance. This mortgage payment calculator provides customized information based on the information you provide. For example, that you’re buying a single-family home as your primary residence. This calculator also makes assumptions about closing costs, lender’s fees and other costs, which can be significant.

Should I increase my mortgage payment and pay off my mortgage early?

This link takes you to an external website or app, which may have different privacy and security policies than U.S. We don't own or control the products, services or content found there. If you’re looking to buy a new home, our purchase or Home Affordability Calculator can help you run the numbers. Use Rocket Mortgage® to see your maximum home price and get an online approval decision. By 2001, the homeownership rate had reached a record level of 68.1%. Only four in ten Americans could afford a home under such conditions.

But mortgage pre-approval does not last indefinitely, since your financial circumstances could change by the time you close your real estate deal. As such, you’ll want to know how long pre-approval lasts before it expires. To calculate your DTI ratio, divide your ongoing monthly debt payments by your monthly income. As a general rule, to qualify for a mortgage, your DTI ratio should not exceed 36% of your gross monthly income. Initially, fixed mortgage rates are typically higher than adjustable mortgage rates. However, fixed mortgage rates also give the borrower some certainty on how much their interest will be in the future.

Fixed-rate loans offer a consistent rate and monthly payment over the life of the loan. They typically have 10-, 15-, 20- or 30-year loan terms, but other terms may be available. The results show a sample monthly payment (excluding taxes and insurance) and the interest you would pay. If you’ve chosen to add an additional payment, it shows you how much interest and how many months of payments you could save by putting extra money toward paying down your principal. There’s also a graph that breaks down how much of your payment goes toward principal and how much goes toward interest.

If Joe were to abide by the 28/36 rule, he’d spend no more than $1,400 on a mortgage payment each month. Borrowers can input both interest rate and APR (if they know them) into the calculator to see the different results. Use interest rate in order to determine loan details without the addition of other costs. The advertised APR generally provides more accurate loan details. The above steps calculate monthly amortization for the first month out of the 360 months in a typical 30-year loan. For the remaining months, repeat steps two through four using the previous outstanding loan balance as the new loan amount for the next month in the schedule.

How much can I get pre-approved for?

As more principal is paid, less interest is due on the remaining loan balance. You can estimate your mortgage loan amortization using an amortization calculator. Depending on how much you change the home price in the mortgage calculator, it could drastically change your estimated monthly mortgage payments. You can play around with those numbers a little to figure out what kind of monthly payment you can afford. Are you considering homeownership for the first time, but aren’t sure what kind of house you can afford? If so, a mortgage calculator is a helpful tool that you can use to determine what your monthly mortgage payments might be.

How to Get A Mortgage?

Mortgage interest rates dip below 7%—see how much you'd pay for a house at the current rate - CNBC

Mortgage interest rates dip below 7%—see how much you'd pay for a house at the current rate.

Posted: Sat, 16 Dec 2023 08:00:00 GMT [source]

Your lender will then re-evaluate your credit history and financial situation. Long-term mortgages typically have higher rates but offer more protection against rising interest rates. Penalties for breaking a long-term mortgage can be higher for this type of term. Mortgage pre-approval should not be confused with mortgage pre-qualification, where you tell a lender about your income and debts but don’t provide documentation to verify your claims. To get the best mortgage interest rates and terms, you’ll want a down payment amounting to 20% of a home’s sale price. But if you don’t have 20%, you can put down as little as 3.5%, or in some cases 0%.

This means that interest will accrue at such a pace that repayment of the loan at the given "Monthly Pay" cannot keep up. If so, simply adjust one of the three inputs until a viable result is calculated. Either "Loan Amount" needs to be lower, "Monthly Pay" needs to be higher, or "Interest Rate" needs to be lower. PMI is calculated as a percentage of your original loan amount and can range from 0.3% to 1.5% depending on your down payment and credit score. Once you reach at least 20% equity, you can request to stop paying PMI. Loan approval is subject to credit approval and program guidelines.

Two of the most common deciding factors are the term and monthly payment amount, which are separated by tabs in the calculator above. Our mortgage amortization calculator takes into account your loan amount, loan term, interest rate and loan start date to estimate the total principal and interest paid over the life of the loan. Adjust the fields in the calculator below to see your mortgage amortization. Your DTI compares your total monthly debt payments to your monthly pre-tax income.

You can even get a mortgage with no down payment requirements when you qualify for a USDA or a VA loan. So, if you’re purchasing a $300,000 home, that means you’ll want to make a down payment of $60,000 before closing on the loan. Your down payment is subtracted from the total amount you borrow.

2) Less interest paid – The interest you pay on a loan depends on the loan balance at the end of each month and your mortgage rate. By making a larger down payment and borrowing less, the outstanding balance will be lower, and the interest you will pay will be lower as well. The following amortization calculation includes both principal repayment and interest. Use our amortization calculator to try more examples and learn more about the amortization process.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the country at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner's insurance and taxes. If you have an escrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance (PMI) or homeowner's association dues (HOA), these premiums may also be included in your total mortgage payment. SmartAsset’s mortgage calculator estimates your monthly mortgage payment, including your loan's principal, interest, taxes, homeowners insurance and private mortgage insurance (PMI).

A mortgage is often a necessary part of buying a home, but it can be difficult to understand what you can actually afford. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price, down payment, interest rate and other monthly homeowner expenses. You’ll also have to pay property taxes to your local government for the surrounding schools, libraries, emergency services and other public services. Like homeowners insurance, property taxes can vary significantly depending on where you live. You’ll likely have the option of paying your property taxes from an escrow account. The Rocket Mortgage calculator takes those taxes into consideration when giving you an estimated monthly mortgage payment.

No comments:

Post a Comment